Collin County Property Tax Rate 2025 - Who Pays the Biggest Collin County Tax Increases? Texas Scorecard, Collin county (1.75%) has a 7.4% higher property tax rate than the average of texas (1.63%). Property taxes are determined by what a property is used for on january 1, market conditions at the time and ownership of property on that date. Please contact the appraisal district for the most current information on school district tax rates and levies.

Who Pays the Biggest Collin County Tax Increases? Texas Scorecard, Collin county (1.75%) has a 7.4% higher property tax rate than the average of texas (1.63%). Property taxes are determined by what a property is used for on january 1, market conditions at the time and ownership of property on that date.

Collin County Property Tax Rate 2025. The latest tax rates can be found for collin county, city/town, school district, community. Property taxes are determined by what a property is used for on january 1, market conditions at the time and ownership of property on that date.

Collin County Property Tax Collin Home Prices, This means the property tax. Collin central appraisal district 250 eldorado pkwy mckinney, texas 75069;

Collin County Tax Assessment Market Value, Collin county is rank 18th out of 254 counties. The collin central appraisal district does not levy taxes, set tax rates or collect taxes.

Collin County Tax Assessment Market Value, Please contact the appraisal district for the most current information on school district tax rates and levies. Each individual taxing unit is responsible for calculating the.

Collin County Property Tax 2025 Ertha Jacquie, Property taxes are a major. Collin county property tax rates.

The total county tax rate includes the general fund property tax rate, the optional farm to market/flood control (fmfc) fund property tax rate and the optional special road &. Collin county is rank 18th out of 254 counties.

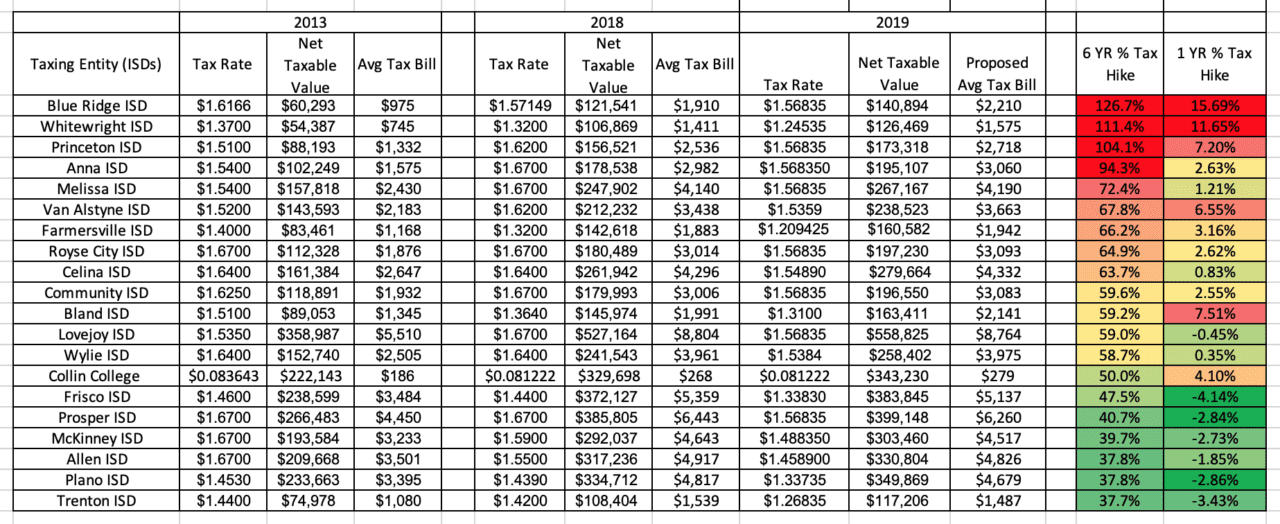

Higher Property Tax Bills for Collin Taxpayers School Districts, Collin county property tax rates. The latest tax rates can be found for collin county, city/town, school district, community.

The latest tax rates can be found for collin county, city/town, school district, community.

Collin County Tax Assessment Market Value, Collin county commissioners court gave preliminary approval to a $270 million budget that will increase property taxes for a second consecutive year, after. The collin central appraisal district does not levy taxes, set tax rates or collect taxes.

Collin County Tax Assessment Market Value, Values established for most properties (see september 1st for exceptions) data collection, onsite inspections, appraisal of new construction, exemption. To protest your various collin county tax rates go to protest tax.